This article will explain the peculiarities of the Federal Reserve Board’s functionality, its structures, and other significant points.

The purpose of a Federal Reserve Board

Federal Reserve Board is a quasi-state structure with private components that are included in the US President Council of the Fed, Federal Committee on the Open Market, twelve regional federal reserve banks – fiscal agents of the US Treasury, Numerals reserve banks of fixed profitability in exchange for reserve capital) and a variety of consulting councils.

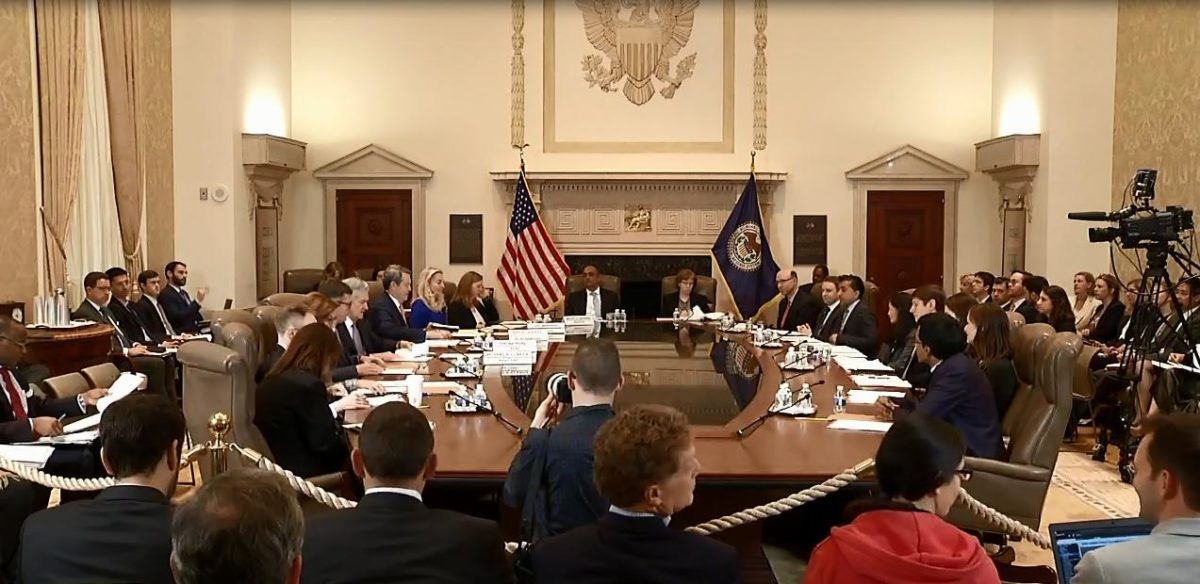

This Federal Reserve Board, which consists of seven members appointed by the US President for 14-year terms, determines the basic principles of monetary policy. In addition, as part of the open market policy, the Federal Open Market Committee decides on the future interest rate policy in the USA. All members of the Board of Governours, the President of the FRB New York, and four other Presidents of other FRBs sit in this body. The Fed operates independently of the US government, so decisions do not require the approval of government officials or agencies. However, the President of the United States still appoints the Fed Board of Directors.

The idea of creating a central bank belonged to Nelson Oldrich, a leader of the Republicans of the Senate. He founded two commissions: one for a deep study of the American monetary system, the other (which he headed independently) – to study and prepare reports on European banking systems.

How does the Board function?

A secret government, consisting of the wealthiest people of the world, was legally legally legally known. The Fed prints the US currency. John Kennedy was the only President seriously set up to change the federal reserve system and print money independently. The Board is responsible for the development and implementation of monetary policy, banking supervision, and the provision of financial services to deposit institutions and the federal government.

The primary method of regulating the federal reserve system of the financial proposal is carried out in the form of actions of the Federal Committee in the market. The Law orders the Board to gather at least every four years. In practice, the Committee members meet about eight times a year.

The Law defines the legal status of the Fed on the Fed in the form of a special financial institution that combines the traits of both an independent legal entity and a public state agency. Although the Fed is subordinate directly to Congress, Congress or the President cannot exert political pressure on its leaders according to the Law. Despite this, the Board of Managers should coordinate their actions with the Politics of the Presidential Administration and Congress. The Federal Reserve does not receive funding from Congress but charges money from investment income and payment for services rendered for operative expenses. When there is a contradiction – to strive to make profits or serve society’s interests, the Fed should choose the second.

Besides, the Board establishes a compulsory reservation ratio for banks and approves discount rates set by regional reserve banks. In general, the Council is watching twelve banks of the federal reserve. In addition, the Council observes and regulates the activities of commercial banks – Feds and bank holdings. All members of the Council are also members of the Federal Committee on Voting Operations in the open market.

In addition, the Fed’s ownership structure is unique and is therefore criticized. Theoretically, the Fed has all commercial banks operating in the system, as Member banks must buy Fed securities in their region. However, the Fed is also perceived as a government agency.